Investing in yourself is more than just acquiring stocks and bonds. When you make conscious decisions to invest in your financial wellbeing, health, career, and interests, you set yourself up for success in the future. Not sure where to start? Try out any of these 37 ways to start investing in yourself today.

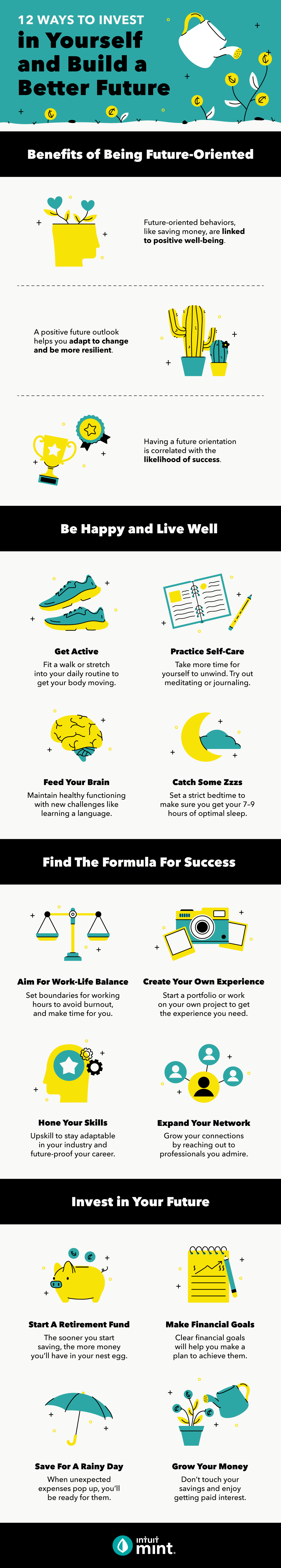

Feel free to jump to the infographic for a quick breakdown of some of the best investments you can make for yourself. Don’t forget to download our motivational wallpapers too!

Invest in Your Future

Your future depends on the investments you make today. If you start early, time can be your friend and not your enemy. Consider investing your money in more than just stocks and bonds, and save specifically for the future.

1. Start A Retirement Fund

There are many ways to save for retirement. The most important thing to remember is that the sooner you start saving, the more money you will accumulate over the years. Use this retirement calculator to estimate how much you should save to meet your retirement goals. Then begin building your nest egg by making contributions to any of these financial accounts:

- 401(k): This is the most common for-profit employer-sponsored retirement plan, and it takes a percentage of your before-tax earnings and saves it in an account. This money isn’t taxable until withdrawn.

- 403(b): This retirement plan is sponsored by tax-exempt/non-profit employers and also invests your pre-tax earnings into a retirement account.

- Roth IRA: This account allows you to make after-tax contributions to your retirement that are tax-free upon withdrawal.

- Traditional IRA: If you’re eligible, a Traditional IRA lets you make tax-deductible contributions to a retirement account.

2. Set Financial Goals

Set financial goals for the future and measure your success by achieving them. Your goals can be short-term, like saving for your next vacation, or long-term, like paying off student loans. For inspiration, find some ideas for financial goals below:

- Making a monthly budget for groceries

- Starting an emergency fund

- Saving for a house

- Helping a loved one pay for school

- Paying off your credit card every month

3. Save For A Rainy Day

Start saving for small expenses that aren’t a part of your regular living expenses with a rainy day fund. This fund will help you with unexpected expenses that pop up like a necessary car repair or replacing a broken laptop. Keep your money easily accessible in a checking or savings account, and use these saving tips for extra cash to put toward your rainy day fund today:

- Cut out unnecessary expenses like to-go coffee

- Cook and eat all your meals at home

- Trim down your subscription services

- Reduce your utility bills

4. Grow Your Savings

When you put your money in a regular savings account, it will pay you a little interest on the money you have in there. However, there are other accounts that may get you a little more bang for your buck. Explore whether these savings options may be right for you:

- High-yield savings account: This is a savings account that pays a higher amount of interest than a normal savings account.

- Money market account: A money market account allows you to make a limited amount of transactions each month and pays a higher interest rate than regular savings. Note that they tend to have a high minimum balance requirement to keep the account open.

- Certificate of deposit: These are also known as CDs and you can deposit your money to earn interest on it for a fixed amount of time. Interest rates may vary and there are penalties for early withdrawals.

Invest in Yourself – Health is Important

You only have one body, so it’s important to invest in it and give yourself the best opportunity for a long and healthy life.

5. Nourish Your Body

Your body needs fuel to run properly, so make sure you give it the nutrients it needs. Eating healthy can help optimize brain function and improve your quality of life. Here are some ways to nourish your body:

- Increase the number of fruits and vegetables in your diet

- Drink at least three liters of water a day

- Take supplements for any vitamin or mineral deficiencies

6. Exercise Regularly

The World Health Organization cautions against the negative effects a sedentary lifestyle can have on your body and mortality. Physical inactivity causes increases in a variety of health problems like diabetes, obesity, depression, anxiety, cancer, and cardiovascular disease. Follow these tips to get more active every day:

- Go for a 30-minute walk or run

- Take stretch breaks often if you sit for long periods of time

- Try out a new exercise routine like cardio or weight training

7. Get Good Sleep

Sleep deprivation is more than just being tired. It comes with many negative health effects for your body and brain like increased risk of high blood pressure or dementia — it’s even shown to age your brain three to five years. Try out these good sleep habits to get your eight hours in:

- Go to bed and wake up at the same time every day

- Use a sound machine to help lull you to sleep

- Create an evening routine that helps you wind down at night without technology

8. Practice Self-Care

Self-care requires you to pay attention to your wellbeing and to do things that safeguard it. Practicing self-care entails doing whatever you need to recover, recuperate, or re-energize. Here are some ideas for practicing self-care on a budget:

- Spend time with loved ones

- Make a habit of journaling

- Try meditation

- Ignore your phone

9. Feed Your Brain

As you age, it’s important to keep your brain active to maintain healthy cognitive functions. Take the time to feed your brain by engaging in new, complex, and challenging activities like the ones listed here:

- Learn a new language

- Express yourself in writing

- Practice painting or art

Invest in Your Career

In addition to investing in your financial future and health, investing in your professional development can also bring meaning to your life.

10. Invest in Yourself With Education

Investing in your education is one of the most common ways you can boost your career. A degree helps you be competitive on the job market and helps you work toward the job of your dreams. College can be expensive and you should know that you don’t have to go into debt to get a good education. Explore your options for getting an education below:

- Community college

- Trade schools

- Online universities

- Four-year universities

11. Gain Experience

To land your dream job, employers often look for a combination of education and experience. Invest in your career by seeking out opportunities to get the experience you need. You can showcase your achievements on your resume and put them to use once you get the job. Any experience is better than none, so try out one of these ideas:

- Apply for an internship

- Create your own portfolio

- Volunteer

- Get a part-time job

12. Hone Your Skills

As the job market and companies evolve, it’s important to keep up with the relevant skills needed in your field. The skills gap is one of the most challenging problems for hiring managers today, so be the answer to their problems by upskilling in these in-demand areas:

- Digital skills

- Soft skills

- Analytic skills

- Leadership skills

13. Expand Your Network

According to a LinkedIn survey, 85% of jobs are filled through networking. Take the time to grow your network by connecting with professionals who can help you get where you want to go. Try out one of these tactics for expanding your network:

Message a professional in your dream line of work for a coffee chat

Attend a networking event or virtual career fair

Ask a connection for an informational interview

14. Start a Side Hustle

Have a passion but not sure how if it would work out as a career? Try it out as a side hustle first! A side hustle can give you a new experience, allow you to work out any problems, build your personal brand, and bring in additional income. There are many different side hustles to start but here’s some inspiration:

- Freelance your writing skills online

- Resell curated consignment finds

- Start a business building websites

- Tutor students in a specialized subject

15. Aim For Work-Life Balance

Part of investing in your career is making sure you don’t burn out early. Avoid this by getting into the habit of maintaining a work-life balance by doing the following:

- Set strict working boundaries to preserve personal time

- Don’t check emails past a set time in the evening

- Eat your meals away from your desk

- Schedule time off and use it to relax and destress

16. Obtain a Certification

Another way to invest in your career is by obtaining professional certifications for new skills. Keep your career opportunities open by earning certifications in areas you don’t already have experience in or getting certified in tools or software that will help you do your job. Check out these certification options:

- Google Certifications

- EdX Certifications

- IBM Certification

- FEMA Certification

17. Find a Mentor

A mentor can help elevate your career by teaching and guiding you through your professional journey. Whether you want to be in business or education, finding an experienced mentor in your chosen industry will help you get where you want to go. Find a mentor using some of these tips:

- Cold email someone in your desired field

- Reach out to industry professionals via social media

- Look for mentors at a virtual conference or meetup

18. Learn to Say No

Choose how you spend your time and energy wisely. Exercise your right to say no if you have too much on your plate or if added responsibilities won’t help you achieve your career goals. Try out a few of these polite ways to say no in a professional setting:

- “Thank you for thinking of me, but I, unfortunately, don’t have the bandwidth this project requires.”

- “I wish I could help, but I’m afraid this is out of my area of expertise.”

- “I appreciate you asking, but I would like to keep developing my skills in these other areas.”

Invest in Yourself with Close Relationships

When it comes to the future, many wish to live a life surrounded by the people we love and enjoy. Make time for the people in your life and work on cultivating your various relationships so they’re that much more meaningful down the line.

19. Spend Time With Family

Family is important, so show them they matter by spending time together. Here are some ideas for how to fit in a little quality time with family:

- Cook a meal together

- Plan a trip to the park

- Have a family game night

- Join them on an errand

20. Have Fun With Friends

You don’t necessarily choose your family, but you do choose your friends. Grow your friendships by engaging in shared activities and making a point to catch up on each others’ lives. Try some of these activities to keep your friendships going:

- Go on a hike

- Play games over video chat

- Start a book club

- Send each other a handwritten note

21. Make Room For Romance

Many people envision themselves settling down with a partner in their future. Significant others are often a great source of happiness and social support in our lives. Try being open to romance, and if you’re in a relationship, score some points with these date ideas:

- Have a picnic in the park

- Plan a movie night with their favorite snacks

- Grab a coffee and go for a stroll

- Watch the sunset together with blankets and hot cocoa

Other Ways to Invest in Yourself

Invest in your own personal development and fulfillment by nurturing your hobbies and passions. Not sure how? Take a look at this list to get inspired and continue investing in yourself.

22. Learn to play an instrument

23. Read a book

24. Play a new game

25. Volunteer for a cause you love

26. Affirm yourself through mantras

27. Discover your spirituality

28. Adopt a pet

29. Take a mental health day

30. Practice a hobby

31. Reward yourself for achieving goals

32. Plan a pamper day

33. Write down what you like about yourself

34. Listen to motivational podcasts

35. Make personal goals

36. Create art

37. Get out of your comfort zone

Use this list to start making investments in yourself today. Whether you start managing your money with the Mint app or make healthy lifestyle changes, every step will help you build a brighter future.

Find motivation to do so with our downloadable wallpaper that features an inspirational quote below.

Sources: Journal of Economic Psychology | Developmental Psychology | Personality and Individual Differences |

The post 37 Ways to Invest in Yourself and Build a Better Future appeared first on MintLife Blog.

The Article Invest in Yourself and Build a Better Future First Appeared ON

: https://gqcentral.co.uk